Mergers and Acquisitions Toolkit - Playbook, Templates and Free sample

Download our approach and a free sample of the Toolkit using a computer:

Mergers and Acquisitions Approach

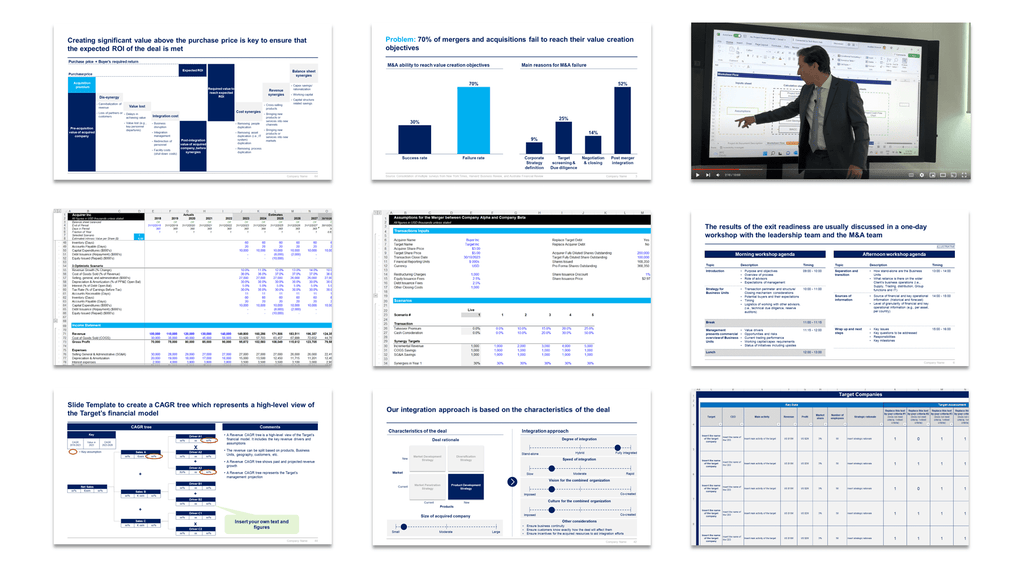

Problem: 70% of mergers and acquisitions fail to reach their value creation objectives.

Solution: Our ex-JP Morgan Investment Bankers, and McKinsey & Deloitte Consultants created an M&A Toolkit to increase your odds of success.

Approach: The Toolkit includes a 7-phase approach that we have built and refined over the past 20 years through constant trial and error: (I) Define your M&A Strategy, (II) Identify Target Companies, (III) Build a Business Case and Financial Model, (IV) Conduct a Due Diligence, (V) Execute Transaction, (VI) Conduct the Post Merger Integration, (VII) Activities specific to Carve-outs.

Phase 1: Define your M&A Strategy

This phase includes 7 sections: (1) Company mission, vision and values, (2) M&A key considerations, (3) M&A strategic objectives and key performance indicators, (4) M&A team, (5) M&A guiding principles, (6) Target screening criteria, (7) Current M&A pipeline.

Phase 2: Identify Target Companies

This phase includes 6 sections: (1) Potential target companies and data collection, (2) High-level assessment of potential target companies, (3) Shortlisted potential targets, (4) Financial statements analysis, (5) Valuation: DCF model, comparable company analysis, and precedent transaction analysis, (6) Targets approved for the business case phase.

Phase 3: Build a Business Case and Financial Model

This phase includes 6 sections: (1) Strategic benefit, (2) Feasibility, (3) Financial benefit, (4) Comprehensive M&A financial model including acquirer model, target model, merger assumptions & analysis, and pro forma model, (5) Simple Financial model including integration cost, revenue synergy, cost synergy, NPV, ROI, and IRR, (6) Letter of intent or term sheet.

Phase 4: Conduct a Due Diligence

This phase includes 5 sections: (1) Data room and clean room, (2) Work plan including key business case hypotheses & assumptions, (3) Due diligence to validate key hypotheses and assumptions, (4) Updated valuation, business case, and financial model, (5) Recommendation to make (or not) a formal offer to acquire the target company.

Phase 5: Execute Transaction

This phase includes 4 sections: (1) Deal structure, (2) Sale and purchase agreement (SPA), (3) M&A negotiations, (4) Signing and closing the M&A deal.

Phase 6: Conduct the Post Merger Integration

This phase includes 6 sections: (1) Integration strategy, (2) Integration & synergy initiatives, (3) Detailed Plans, (4) Implementation & Monitoring, (5) Change Management and Internal Communication, (6) Stakeholder Engagement.

Phase 7: Activities specific to Carve-outs

This phase includes 6 sections: (1) Exit readiness, (2) Transaction perimeter , (3) Separation concepts, (4) Management presentation, (5) Legal entity, (6) Separation execution.

Download our approach and a free sample of the Toolkit using a computer:

Need more help? Check our Toolkits:

- Mergers and Acquisitions Toolkit

- Post Merger Integration Toolkit

- Management Consulting Toolkit

- Corporate and Business Strategy Toolkit

- Sales, Marketing & Communication Strategy Toolkit